Tackling Credit in 2024

As we close the book on 2023 and get ready for a new year, one of the most common things that we get asked about on a weekly basis is the subject of credit, ie how to build good credit and how to turn bad credit into good credit. All of this is super easily achievable if you or someone you know is just willing to put in a bit of time and some elbow grease and we can be there along for the journey as well to help out as guides.

Over the years in addition to the homebuying process, we've helped several people either build credit, or turn bad credit into good credit before the homebuying journey began and actually this isn't the first time we've written about it

(check out other past posts we've done here .)

If this is something you or someone you know needs some guidance with, we'd love to sit down with you and help. For the price of a cup of coffee at your coffehouse of choice, we can help get a custom plan going. This is a great goal to start the new year off by tackling.

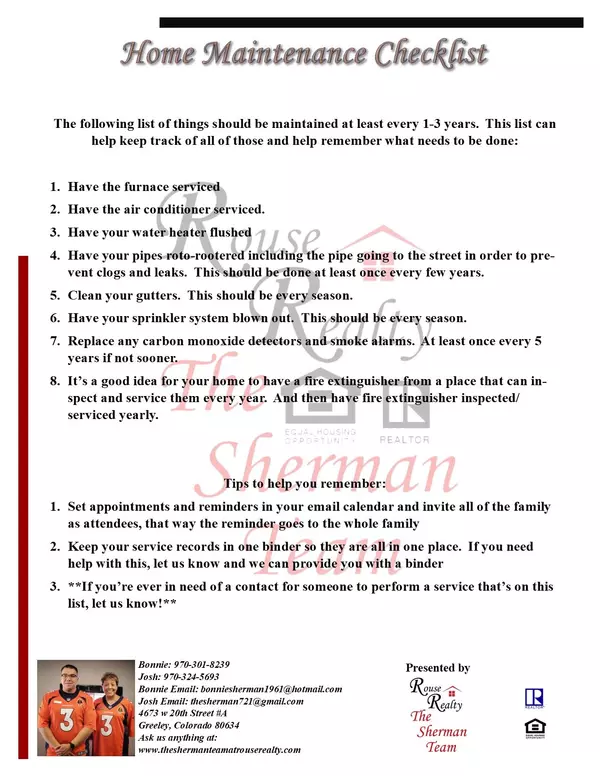

The Importance Of Home Maintenance

In our industry, a ton of energy goes into buying and selling homes but in this post, we’re going to spend a bit of energy into raising awareness about keeping your home in good shape in order to avoid big repair bills down the road because routine maintenance items were neglected. Additionally, the last thing anybody wants to have happen during a sale of a house is to be finding out that a pricey list of items needs fixed. Below is a checklist that we’ve come up with that have items that should be maintained regularly. It’s available to save and/or screenshot. If anybody has any questions, don’t hesitate to reach out.

3 More Credit Uh-Oh’s That Can Affect Pre-Approval

We’re back, continuing the Ultimate Pre-Approval Cheat Sheet with Allan Salter with Mac 5 Mortgage and he’s once again lending some of his extensive knowledge on credit, purely because that’s the biggest subject we get asked about. In this video, Allan lays out three more things regarding credit that just plain need to be thought about:

*Not having any charge accounts

*The pros and cons of being an authorized user

*The consequences of co-signing on a credit account.

Bonnie & Josh Sherman

Phone:+1(970) 301-8239